If you run a business in Nepal, getting a Tax Clearance Certificate (TCC) is very important. This certificate proves that your company or business has paid all its taxes. You may need it when closing a company, transferring shares, or renewing business licenses.

In this guide, we will explain what a TCC is, why it is important, who needs it, and how to get one in Nepal.

What is a Tax Clearance Certificate?

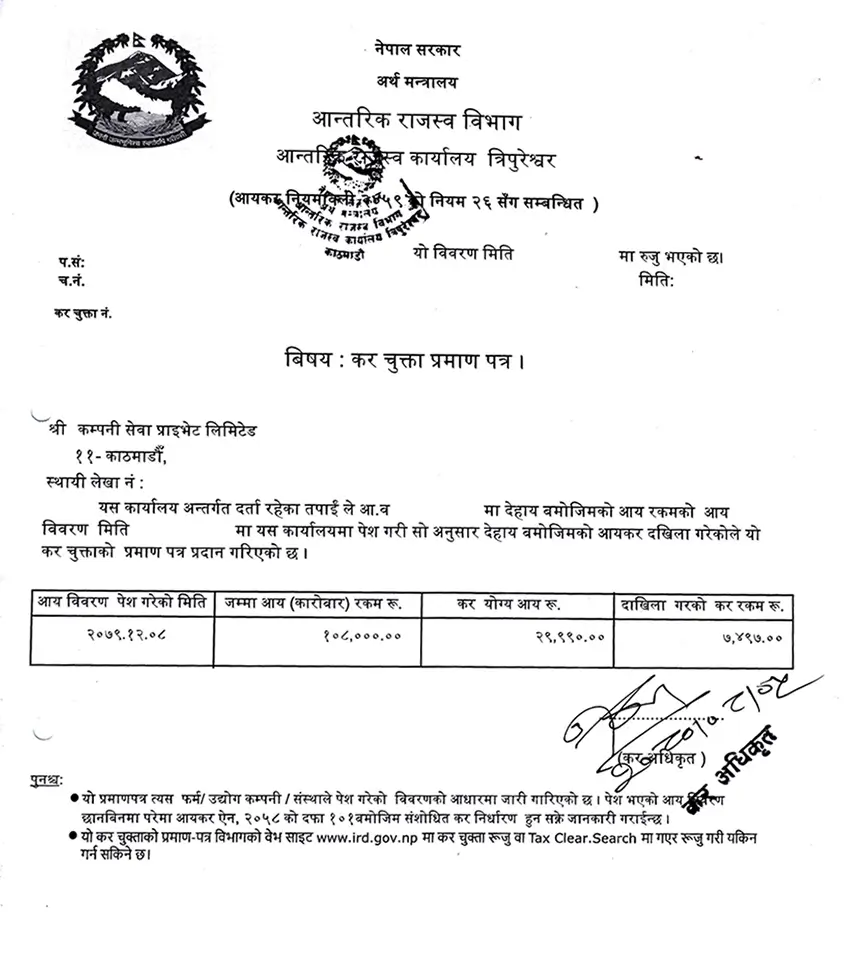

A Tax Clearance Certificate (TCC) is an official document from the Inland Revenue Department (IRD). It shows that a company or individual has paid all taxes for a fiscal year.

In Nepali, it is called “Kar Chukta” (कर चुक्ता).

Why is a Tax Clearance Certificate Important?

- Needed for closing or deregistering a company

- Required when transferring shares or changing ownership

- Necessary for renewing business licenses or participating in government tenders

- Confirms that your business is tax-compliant

Who Needs a Tax Clearance Certificate?

- Registered companies (Private Limited, Public Limited)

- Partnership firms

- NGOs/INGOs

- Individual taxpayers doing business or consultancy

- Businesses planning to close or exit the market

Documents Needed for a Tax Clearance Certificate

To get a TCC in Nepal, you usually need:

- PAN/VAT certificate

- Tax returns for current and past fiscal years

- Audit report (if applicable)

- Receipts for tax payments, advance tax, or installments

- Company registration certificate (copy)

- Board Resolution or Power of Attorney (if applying through a representative)

- Cover letter addressed to the Tax Officer

- Proof of payment for any outstanding taxes

Step-by-Step Process to Get a Tax Clearance Certificate in Nepal

Here’s a simplified guide to help you understand how to apply for a Tax Clearance Certificate in Nepal:

- Step 1: File Your Tax Returns and Pay Dues

- Step 2: Prepare Required Documents

- Step 3: Submit Your Application

- Step 4: Verification and Approval

- Step 5: Receive Your Tax Clearance Certificate

Step 1: File Your Tax Returns and Pay Dues

Submit all your VAT, TDS, and Income Tax returns for the fiscal year. Pay any unpaid taxes, fines, or penalties. You can check your status on the IRD portal or ask a tax advisor.

Step 2: Prepare Required Documents

Collect all required documents, including payment receipts and audit reports.

Step 3: Submit Your Application

Take your documents to the Inland Revenue Office. If someone else is applying for you, include a Power of Attorney or Board Resolution.

Step 4: Verification and Approval

The Tax Officer will check your tax records and payments. If everything is correct, your application will be approved.

Step 5: Receive Your Tax Clearance Certificate

After approval, you will get your Tax Clearance Certificate, either in print or digitally through the IRD portal.

How Long Does It Take?

It usually takes 2–5 working days, depending on the office workload and your tax record status.

Need Help with Tax Clearance in Nepal?

At Company Sewa, we help businesses get their Tax Clearance Certificates quickly and easily. We provide:

- Fast processing

- Affordable service

- Support all over Nepal

📞 Call us at +977-9851253180 to get started today!

Sample of Tax Clearance Certificate Nepal

Need Help? Get Expert Guidance

Avoid delays and rejections. Let Mr. Dipendra Shah (10+ years experience) guide you.

WhatsApp / Call: +977 9851 253 180