Registering a Business PAN (Permanent Account Number) is one of the first steps for any business in Nepal. A PAN is a unique ID number for your business issued by the Inland Revenue Department (IRD).

It is required for:

- Paying taxes

- Opening a business bank account

- Running your business legally

With the online system, you can now apply for a PAN from anywhere in Nepal. This guide will explain the step-by-step process, the documents you need, fees, and common mistakes to avoid.

What is a Business PAN?

A Business PAN is a 9-digit number given by the IRD to track business taxes and finances. Every registered business in Nepal—whether a sole proprietorship, partnership, or company—needs a PAN.

Key Points:

- Purpose: Identifies your business for taxes

- Who Needs It: All registered businesses

- Legal Requirement: Required to file taxes, open bank accounts, and issue invoices

- Difference from Individual PAN: Business PAN is for the company, not personal income

Having a PAN helps you keep clear financial records, build trust with banks and clients, and avoid fines from the tax office.

Documents Required for Business PAN Registration

To register online, you need the following:

| Document | Purpose |

|---|---|

| Business Registration Certificate | Proves your business is legal |

| Memorandum and Articles of Association | Provides the company’s constitution and rules |

| Owner’s Citizenship Certificate or Passport | Verifies the identity of the owner(s) |

| Personal Pan | Required to link the business PAN with the owner(s)’ personal PAN |

| Business Address Proof | Shows your business location (rental agreement, or property document) |

Tip: Make sure all documents are clear, valid, and up-to-date. Missing or wrong documents are the main reason for rejection.

Step-by-Step Process to Register Business PAN Online in Nepal

Registering a Business PAN in Nepal is now easier with the online system provided by the Inland Revenue Department (IRD). Follow these simple steps to complete your application quickly:

- Step 1: Visit the Official IRD Website

- Step 2: Fill Out the Online PAN Form

- Step 3: Submit and Print the Acknowledgement Slip

- Step 4: Visit the Tax Office for Verification

- Step 5: Receive Your PAN Certificate

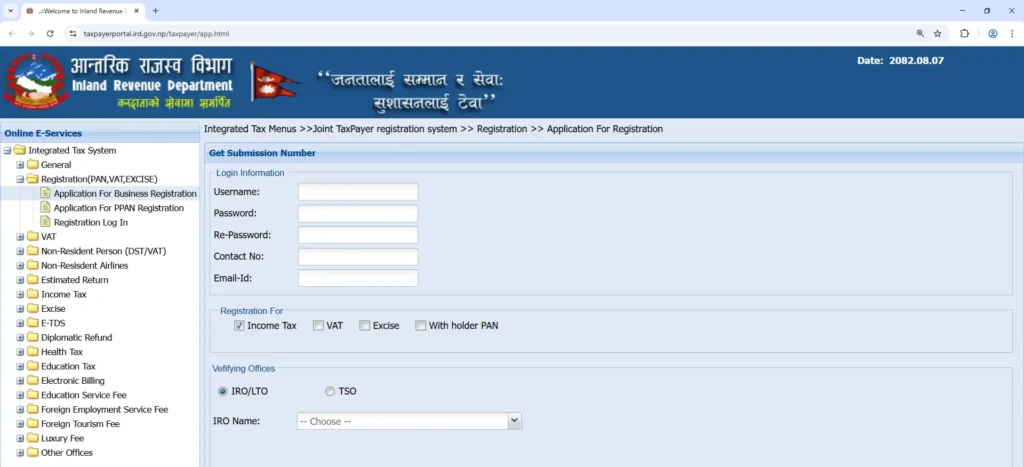

Step 1: Visit the Official IRD Website

- Open the IRD portal:: https://ird.gov.np.

- Click “Taxpayer Portal”

- Select “Register for PAN / VAT”

Step 2: Fill Out the Online PAN Form

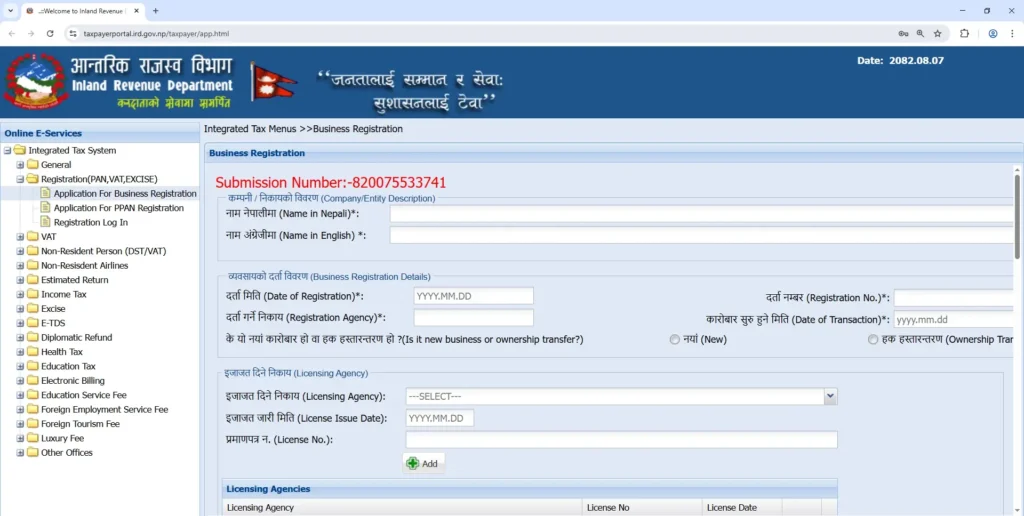

- Choose “Business PAN” (not personal PAN)

- Enter your company details: name, registration number, date, and type of business

- Add shareholder or director information

- Enter your business address and contact number

- Upload scanned copies of all required documents

Step 3: Submit and Print the Acknowledgement Slip

- After submitting the form, download or print the submission slip

- The slip has your submission number, which you will need for verification at the tax office

Step 4: Visit the Tax Office for Verification

Take these items with you:

- Printed PAN application form

- All original documents

- Company stamp

- Photocopies of the documents

The IRD officer will check your documents and register your business.

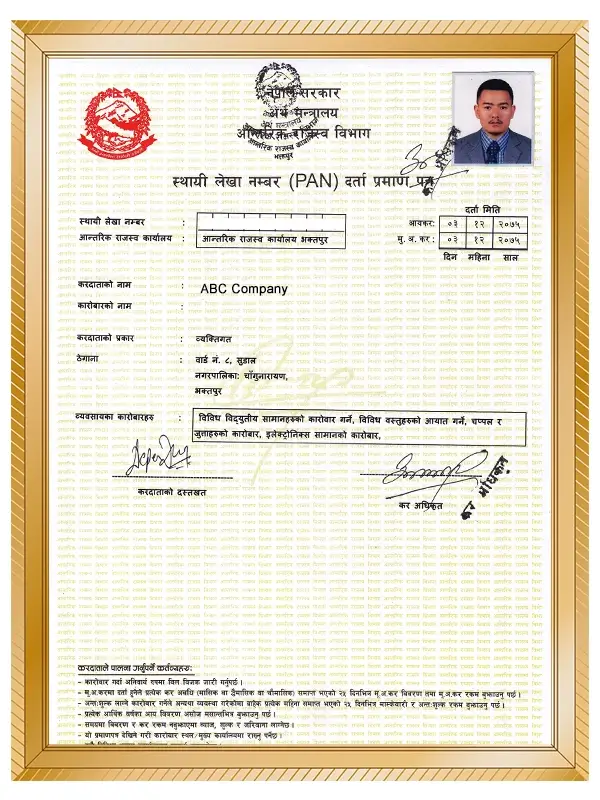

Step 5: Receive Your PAN Certificate

- After verification, you will get your official Business PAN Certificate

- It contains your PAN number, company name, and tax office details

Sample of Business PAN Certificate

Common Mistakes to Avoid

| Mistake | How to Avoid |

|---|---|

| Wrong Business Name | Match exactly with registration certificate |

| Missing Documents | Upload all required documents clearly |

| Incorrect Owner Info | Check citizenship or passport details |

| Invalid Contact Info | Provide correct email and mobile number |

| Late Submission | Submit early to avoid delays |

Pro Tip: Review your application carefully. Small errors are the main reason for rejection.

Difference Between Business PAN & VAT

| Feature | Business PAN | VAT Registration |

|---|---|---|

| Purpose | Unique ID for tax | For collecting and paying VAT |

| Who Needs It | All registered businesses | Businesses with turnover > NPR 20 lakh |

| Issued By | IRD | IRD |

| Use | Filing income tax, opening bank accounts | Charging VAT, filing VAT returns |

| Mandatory | Yes | Only for businesses above turnover threshold |

👉 If your business crosses the VAT limit, read: How to Register for VAT in Nepal.

After Registration – What to Do Next

- Link PAN with Your Bank Account: Most banks need PAN to open business accounts

- Use PAN for Tax Filing: PAN is needed to file income tax returns

- Keep Digital and Physical Copies: Use both printed and digital copies for official transactions

- Link PAN with Other Registrations: For VAT, import/export licenses, or other approvals

- Stay Updated with IRD Notifications: Check email or SMS for tax updates to avoid fines

Pro Tip: Treat your Business PAN like a digital identity for your business. Proper use makes future tax and financial tasks easier.

Frequently Asked Questions (FAQs)

Is PAN registration mandatory for all businesses in Nepal?

Yes, PAN registration is compulsory for all types of businesses, including sole proprietorships, partnerships, and companies.

What is the complete process of registering a Business PAN in Nepal?

- Step 1: Visit the Official IRD Website

- Step 2: Fill Out the Online PAN Form

- Step 3: Submit and Print the Acknowledgement Slip

- Step 4: Visit the Tax Office for Verification

- Step 5: Receive Your PAN Certificate

Can I operate a business without PAN in Nepal?

No, it is illegal to operate a business without a valid PAN. You need a PAN to issue VAT/PAN bills, open a business bank account, and pay taxes.

How long does it take to get a Business PAN?

Typically, it takes 1 to 2 working days after submitting all the necessary documents.

Is there any fee for PAN registration?

No, the government does not charge a fee for issuing a PAN number

Do I need to renew my PAN every year?

No, once issued, PAN is permanent and does not need renewal. However, businesses must file regular tax returns to keep their PAN active.