Understanding VAT (Value Added Tax)

VAT, or Value Added Tax, is a type of consumption tax that applies to the sale of goods and services.

In Nepal, the VAT (Value Added Tax) is regulated by the VAT Act of 2052. The VAT rate in Nepal is 13% of the net selling price of goods and services. This 13% is added to the customer’s invoice.

VAT is levied at each stage of the production and distribution chain. Here’s how it works:

- Production Stage: When a manufacturer produces a product, they pay VAT on the materials and components they purchase.

- Distribution Stage: When the manufacturer sells the product to a wholesaler, VAT is applied to the sale.

- Retail Stage: When the wholesaler sells the product to a retailer, VAT is applied again.

- Final Sale to the Consumer: When the retailer sells the product to the end consumer, VAT is once again added to the sale.

Who needs to register for VAT in Nepal?

Not all businesses need to register for VAT in Nepal. Here are the key points for VAT registration in Nepal:

- Threshold Turnover: Businesses need to register for VAT if their annual turnover exceeds a specific threshold.

- Services: Annual turnover more than NPR 20 Lakh.

- Goods: Annual turnover more than NPR 50 Lakh.

- Mixed (Goods & Services): Annual turnover more than NPR 20 Lakh.

- Mandatory Registration: Some businesses, regardless of turnover, are required to register for VAT. Check the List of Companies Mandatory to Register for VAT in Nepal.

How to Register a Business for VAT in Nepal

Registering a business for Value Added Tax (VAT) in Nepal involves several steps. Here is a step-by-step guide to help you navigate the process:

- Obtain a PAN (Permanent Account Number)

- Prepair Required Documents

- Complete the Registration Form Online

- Visit the nearest Inland Revenue Department (IRD) Office

- Verification

- VAT Certificate Issuance

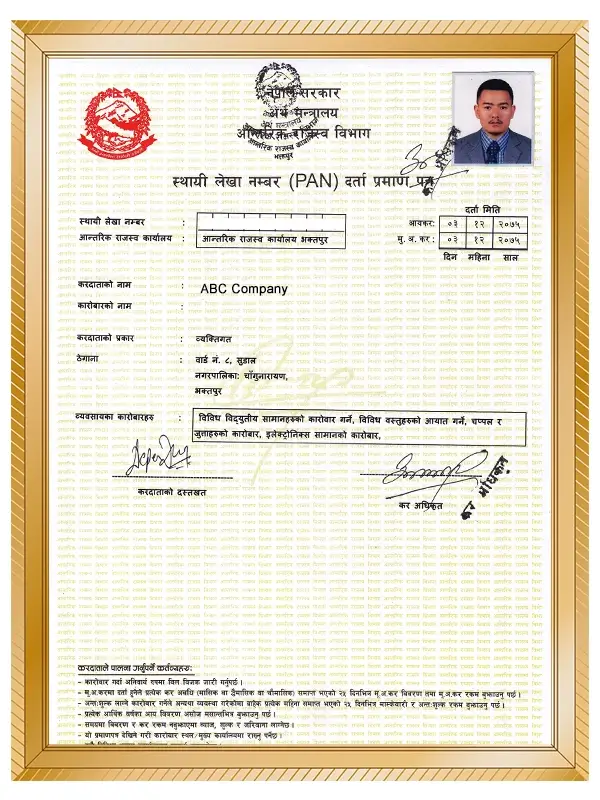

Step 1: Obtain a PAN (Permanent Account Number):

Before applying for VAT registration, make sure your business has a PAN. You can get one from the Inland Revenue Department (IRD) in Nepal.

Step 2: Prepair Required Documents:

Prepare the necessary documents, such as:

- Business registration certificate

- Copy of PAN certificate

- Memorandum of Association and Articles of Association

- Passport-sized photographs of the business owner(s)

- Copy of citizenship certificates of the business owner(s)

- Rental agreement for the business premises

Step 3: Complete the Registration Form Online:

- Visit the Inland Revenue Department (IRD) website: Go to https://ird.gov.np/

- Access Tax Payer Portal: Click on the “Tax Payer Portal” link under the Services menu.

- Navigate to Registration: On the left side, click on the “Registration (PAN, VAT, EXCISE)” tab.

- Find the registration application: Expand the vertical menu to locate the registration application.

- Fill out the form: Provide accurate and complete information about your business, including Business Registration Date, Registration Number, Place of Registration, date of commencement of Business, Citizenship/Passport of Managing Director, etc.

- Save and submit: Save your information and submit the application.

- Print the application: Click on the “Print” button to get a copy of the submitted application form.

Step 4: Visit the nearest Inland Revenue Department (IRD) Office:

Go to the nearest IRD office and submit the printed application form to the concerned officer. All submitted applications will be displayed in the Submitted List in the IRO/TSO officer’s portal.

Step 5: Verification:

The tax authorities will review your application and request biometric data (Fingerprint and Face).

Step 6: VAT Certificate Issuance:

If your application is approved, you will receive a VAT registration certificate.

Sample of Business PAN and VAT Certificate

Difference between PAN & VAT

In Nepal, both PAN (Permanent Account Number) and VAT (Value Added Tax) play important roles in financial and business transactions.

Here’s a simplified breakdown of the key differences between PAN and VAT:

| Aspect | PAN (Permanent Account Number) | VAT (Value Added Tax) |

|---|---|---|

| Purpose | Used for income tax-related purposes. | Applied to the sale of goods and services. |

| Applicability | Mandatory for individuals and businesses with taxable income. | Applicable to businesses involved in the production and sale of goods and services. |

| Function | Identifies taxpayers and facilitates the assessment and collection of income tax. | Levied on the value added to goods or services at each stage of the supply chain. |

| Registration | Individuals and businesses need to apply for PAN registration with the Inland Revenue Department. | Businesses meeting the turnover threshold must register for VAT with the Inland Revenue Department. |

| Frequency of Transactions | Associated with all financial transactions, including income, investments, and expenses. | Specifically linked to transactions involving the sale of goods and services. |

| Penalties for Non-Compliance | Non-compliance may result in fines or other penalties. | Failure to register for VAT or comply with regulations may lead to penalties or legal action. |

How to Calculate VAT in Nepal

- Understand the VAT Rate: The standard VAT rate in Nepal is 13%, but there are different rates for certain goods and services, and some items may be exempt from VAT.

- Determine the Taxable Value: The taxable value is the total value of goods or services before VAT is applied. For example, if you are selling a product for NPR 1,000, the taxable value is NPR 1,000.

- Calculate VAT: Multiply the taxable value by the VAT rate. Formula: VAT Amount = Taxable Amount * VAT Rate

Using the standard rate of 13%, if the taxable value is NPR 1,000: VAT = 1,000 * 0.13 = NPR 130 - Total Price Including VAT: Add the VAT amount to the original taxable amount to find the total price the customer needs to pay. Formula: Total Price = Taxable Value + VAT

Example:

Let’s say you are selling a product for NPR 1,000 with a VAT rate of 13%.

- Identify the VAT Rate: 13%

- Calculate the Taxable Amount: NPR 1,000

- Apply the VAT Rate: VAT Amount = NPR 1,000 * 0.13 = NPR 130

- Determine the Total Price: Total Price = NPR 1,000 + NPR 130 = NPR 1,130

By following these simple steps, you can ensure accurate VAT calculations.