A tax clearance certificate is an official document issued by the Inland Revenue Department (IRD). It verifies that an individual or business has fulfilled their tax obligations for a specific fiscal year.

Having this certificate is beneficial for various purposes, such as obtaining visas, participating in tenders, or conducting financial transactions.

4 Steps to Obtain a Tax Clearance Certificate

Here is a step-by-step guide on how to obtain a tax clearance certificate online in Nepal:

- Step 1: Prepare the audit report and submit income details.

- Step 2: Pay all taxes and TDS.

- Step 3: File ETDS.

- Step 4: Submit an application request for tax clearance certificate with the IRD.

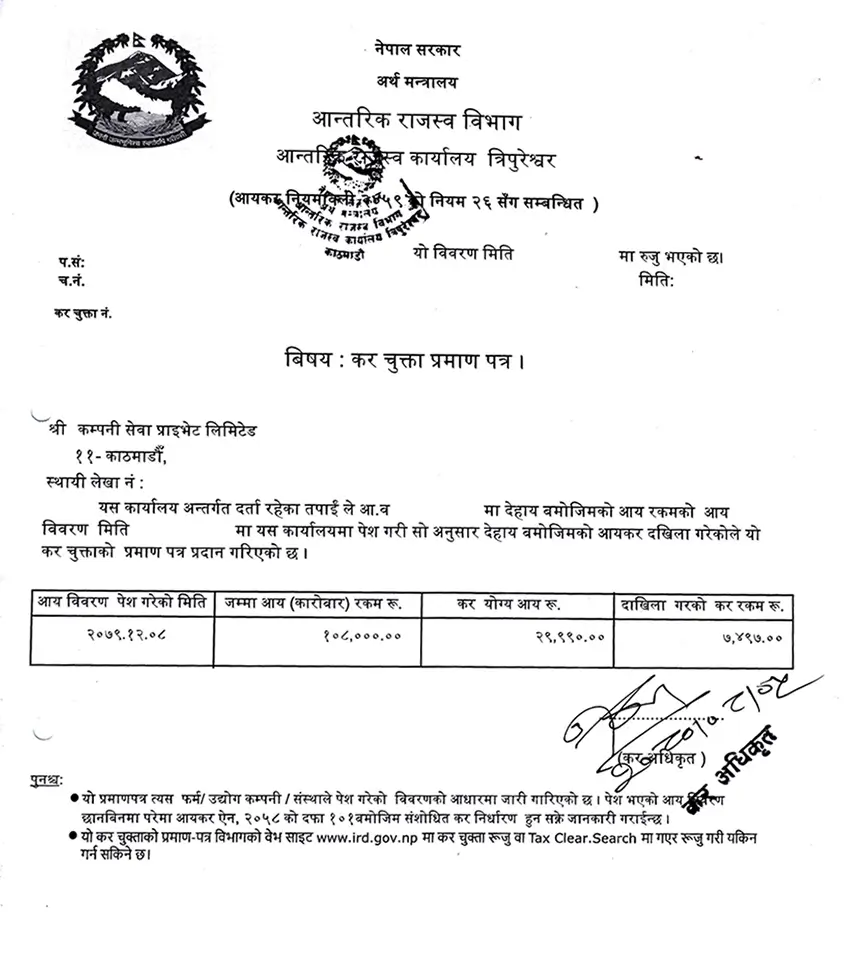

Sample of Tax Clearance Certificate Nepal