A Business PAN, which stands for Business Permanent Account Number, is like a special ID for businesses in Nepal. It’s given by the Inland Revenue Department (IRD) of the Government of Nepal.

Every type of business in Nepal, whether it’s a company, partnership, or even a business run by a single person (sole proprietorship), must have its own Business PAN.

Procedure to Register a Business PAN in Nepal

Registering a Business PAN in Nepal involves a series of steps. By following these steps carefully, you can ensure a smooth PAN registration process for your business.

- Prepare Required Documents

- Visit the Inland Revenue Department (IRD)

- Obtain PAN Application Form

- Submit Application and Documents

- Verification Process

- Receive PAN Certificate

Step 1: Prepare Required Documents:

Gather the necessary documents for PAN registration, which may include:

- Company registration certificate

- Citizenship certificate of business owner(s)

- Passport-sized photographs of the business owner(s)

- Business address proof (e.g., lease agreement)

- Copy of citizenship or passport for foreign investors (if applicable)

- Copy of the company’s Memorandum of Association and Articles of Association (for companies)

Step 2: Visit the Inland Revenue Department (IRD):

Visit the nearest Inland Revenue Department (IRD) office to initiate the PAN registration process.

Step 3: Obtain PAN Application Form:

Get a PAN application form from the Inland Revenue Office or download it from their official website.

Fill it out carefully with accurate and complete information. Make sure the information matches what you provided when registering your business.

Step 4: Submit Application and Documents:

Submit the filled-out application form along with the required documents to the IRD office. Double-check to ensure that all necessary documents are attached.

You will be need to pay the prescribed PAN registration fee.

Step 5: Verification Process:

The Inland Revenue Office will review your application and documents. This process may take some time, so be patient.

Step 6: Receive PAN Certificate:

After your application is accepted, you will be issued a PAN certificate. This certificate officially registers your business and provides you with a unique PAN for tax-related transactions.

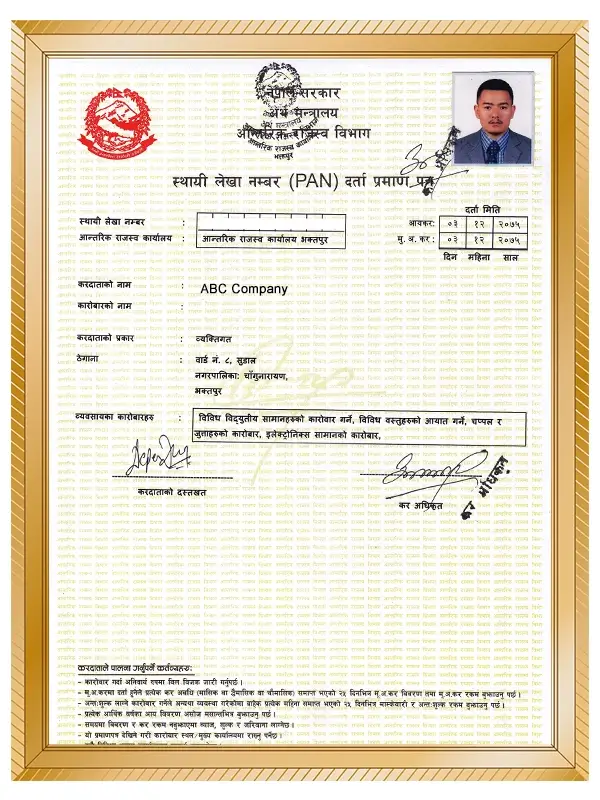

Sample of Business PAN Certificate

Importance of a Business PAN

A Business PAN (Permanent Account Number) in Nepal serves several important purposes:

- Taxation: Businesses use their Business PAN for essential tax-related tasks such as filing income tax returns, paying taxes, and benefiting from tax deductions and credits.

- Opening Bank Accounts: When businesses open bank accounts, banks and financial institutions usually require the Business PAN as part of the documentation.

- Registering for Value Added Tax (VAT): To engage in certain business activities, having a Business PAN is necessary for registering for Value Added Tax (VAT).

- Legal Transactions: The Business PAN is important for various legal and financial activities, including buying and selling property, obtaining business licenses, and participating in government contract bids.

- Obtaining Licenses and Permits: Government departments and agencies often request the Business PAN when issuing licenses and permits to businesses.

- Financial Transactions: The PAN is involved in financial transactions such as applying for loans, writing checks, and depositing significant amounts of cash