Introduction

2025 is the best time to start your company in Nepal.

The Government of Nepal is also supporting new business owners. You will get many benefits after you register your company.

One big benefit is the startup loan. This loan is only for new businesses. You can get from NPR 5 lakh to NPR 20 lakh. The interest rate is only 3% per year. You also do not need collateral. Your business project plan works as security. So many young people can start a company without fear.

The government has also kept a big budget for this program. The budget this year is NPR 73 crore. This money will support hundreds of startups. So, if you register your company in 2025, you have a good chance of getting help.

Online systems also make the process easy. You do not need to stand in long lines. You can register your company from home. In 2024–2025, more than 15,000 companies were registered online. This shows the online system is simple and trusted.

In this guide, you will learn how to register a company in Nepal using the upgraded OCR online system. Everything is explained step-by-step in simple language.

Types of Companies in Nepal

Nepal allows several company types. Choosing the right type is important.

| Company Type | Minimum Capital | Members | Tax Rate | Suitability |

|---|---|---|---|---|

| Private Limited (Pvt. Ltd.) | NPR 100,000 | 1–101 | 25% | Most startups |

| Public Limited (Ltd.) | NPR 10 million | 7+ | 25% | Large businesses |

| Non-Profit Company (NGO/INGO) | NPR 100,000 | 7+ | Exempt | NGOs/INGOs |

| Branch or Liaison office | NPR 100,000 | N/A | 25% | Foreign companies |

For more details, see our detailed guide on types of companies in Nepal.

Eligibility Criteria for Company Registration

| Criteria | Requirement |

|---|---|

| Promoters/Shareholders | At least one (Nepali or foreign national with valid ID/passport) |

| Directors | Minimum one director (can be the same as a shareholder) |

| Registered Office | Must have a valid address in Nepal |

| Age and Capacity | Must be at least 18 years old and legally capable |

| No Disqualification | Cannot be bankrupt or convicted of a business-related crime |

| Foreign Investors | Must follow the Foreign Investment and Technology Transfer Act (FITTA) |

How to Register a Company in Nepal Online (Step-by-Step 2025)

Here is a quick overview of the registration process:

- Reserve Your Company Name

- Prepare Required Documents

- Submit Your Application Online

- Pay the Registration Fee Online

- OCR Review and Approval

- Download Your Company Registration Certificate

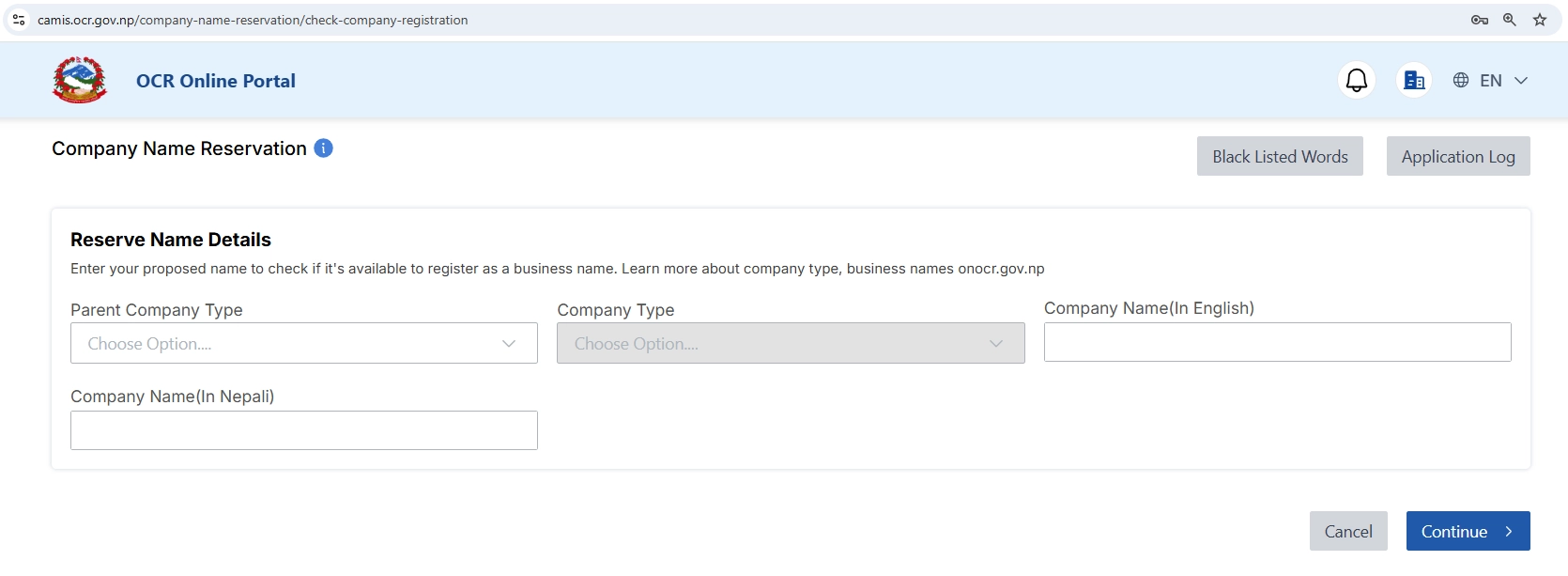

Step 1: Reserve Your Company Name

Your company name must follow OCR rules:

- Unique

- Related to your business

- Not similar to existing names

- No restricted words like bank, finance, NGO, govt (without approval)

How to Reserve a Company Name

- Go to OCR online portal: https://camis.ocr.gov.np/login

- Create an account and log in

- Select “Name Reservation”

- Enter details: company type, proposed name (Nepali & English), objectives

- Submit your application

Processing time: Usually 1–3 days

Common Rejection Reasons

- Name already registered

- Name too generic

- Wrong order of words

- Restricted words

- Missing or unclear company objectives

Pro Tip: Keep 3–5 backup names ready.

Step 2: Prepare Required Documents

Once your name is approved, prepare these documents:

For Nepali Citizens

| Document | Description |

|---|---|

| Memorandum of Association (MOA) | Defines company objectives, capital, and shareholder rights |

| Articles of Association (AOA) | Rules for company management and operations |

| Citizenship Copies of Shareholders/Directors | Scanned copies of shareholders’ and directors’ citizenship |

| Personal PAN | Personal PAN of shareholders/directors |

| National ID | National ID of shareholders/directors |

For Foreign Individual Investors

Additional documents required if any founder/shareholder is foreign:

| Document | Description |

|---|---|

| Passport Copy | Certified copy of the passport |

| Visa / Identification | Proof of legal status in Nepal or valid ID |

| Foreign Investment Approval | Permission from the relevant authority (e.g., Department of Industry) |

| Power of Attorney | If a representative is used, notarized PoA required |

| Translated Documents | Certified translation if documents are not in Nepali/English |

For Foreign Company Investors

If a foreign company invests, these are required in addition to the above:

| Document / Requirement | Description |

|---|---|

| Company Registration Certificate | Certified incorporation certificate of the foreign company |

| MOA and AOA of the Foreign Company | Memorandum and Articles of Association of the foreign company |

| Board Resolution | Board approval for the investment in Nepal |

| Authorized Signatory’s ID | Passport/ID of the person representing the foreign company |

| Foreign Investment Approval | Permit from Nepal’s competent authority |

| Joint Venture Agreement (if relevant) | If investing via a joint venture with a Nepali partner |

| Power of Attorney | If a representative handles registration in Nepal |

| Translated and Legalized Documents | All foreign documents must be legalized and translated if not in Nepali/English |

Important: MOA & AOA must be drafted correctly. Even minor mistakes can cause rejection. Company Sewa can prepare professional drafts with near-zero rejection.

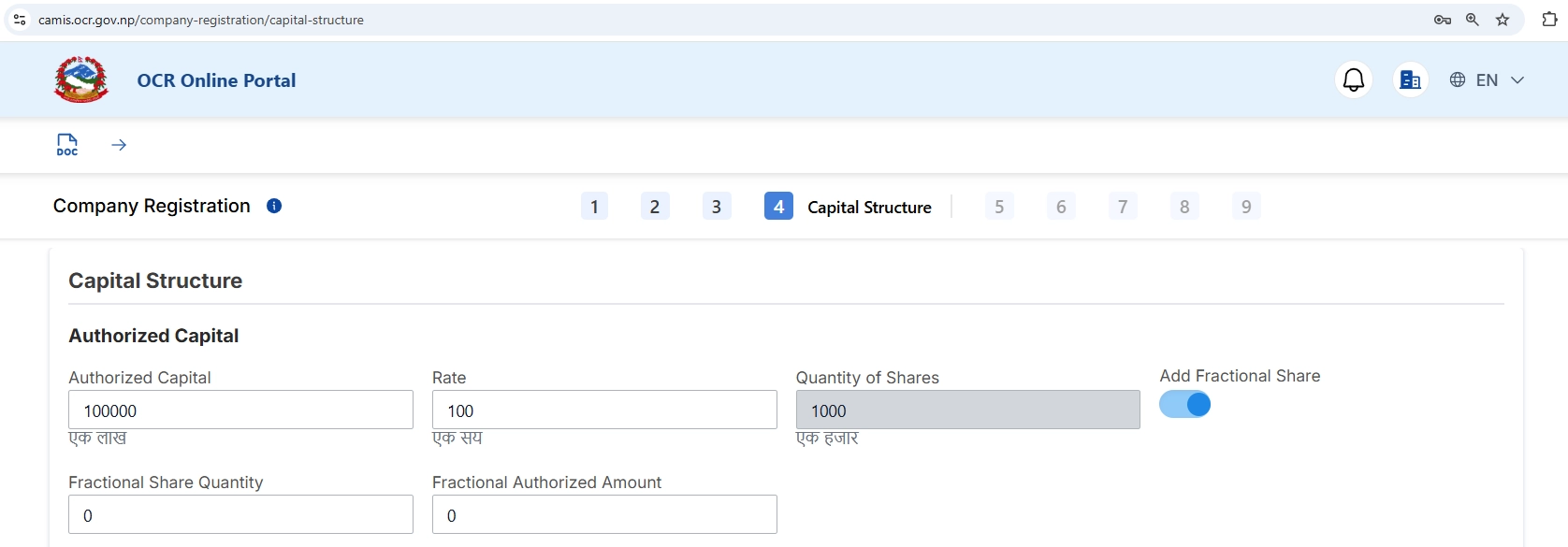

Step 3: Submit Your Application Online

Steps:

- Login to CAMIS: https://camis.ocr.gov.np/login

- Select “Company Registration”

- Fill all forms carefully

- Upload documents (PDF format)

- Review all details carefully

- Submit your application

Your dashboard will show:

- Application status

- Correction notes (if any)

- Final approval

Important: Double-check everything. Even small typos can cause rejection.

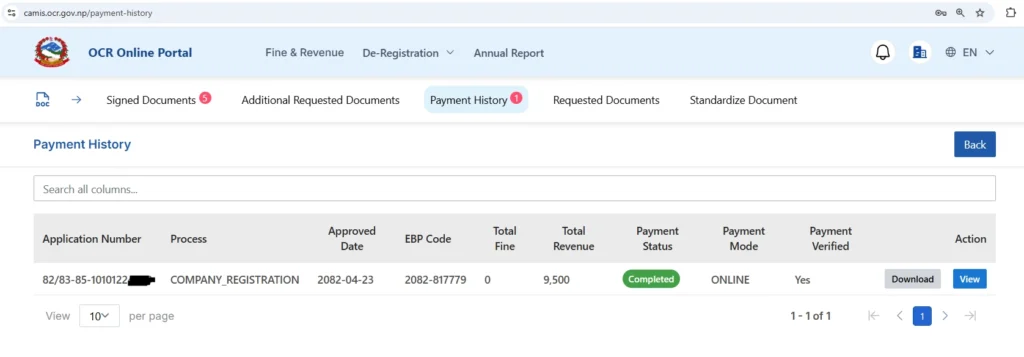

Step 4: Pay the Registration Fee Online

After approval, pay the registration fee via: ConnectIPS, eSewa, or Bank

Private Limited Company Fees (NPR)

| S.N. | Authorized Capital (NPR) | Registration Fee (NPR) |

|---|---|---|

| 1 | Up to 1,00,000 (one lakh) | 1,000 |

| 2 | 1,00,001 – 5,00,000 (one lakh one to five lakh) | 4,500 |

| 3 | 5,00,001 – 25,00,000 (five lakh one to twenty-five lakh) | 9,500 |

| 4 | 25,00,001 – 1,00,00,000 (twenty-five lakh one to one crore) | 16,000 |

| 5 | 1,00,00,001 – 2,00,00,000 (one crore one to two crore) | 19,000 |

| 6 | 2,00,00,001 – 3,00,00,000 (two crore one to three crore) | 22,000 |

| 7 | 3,00,00,001 – 4,00,00,000 (three crore one to four crore) | 25,000 |

| 8 | 4,00,00,001 – 5,00,00,000 (four crore one to five crore) | 28,000 |

| 9 | 5,00,00,001 – 6,00,00,000 (five crore one to six crore) | 31,000 |

| 10 | 6,00,00,001 – 7,00,00,000 (six crore one to seven crore) | 34,000 |

| 11 | 7,00,00,001 – 8,00,00,000 (seven crore one to eight crore) | 37,000 |

| 12 | 8,00,00,001 – 9,00,00,000 (eight crore one to nine crore) | 40,000 |

| 13 | 9,00,00,001 – 10,00,00,000 (nine crore one to ten crore) | 43,000 |

| 14 | Above 10,00,00,000 (above ten crore) | 30 per one lakh of authorized capital |

Public Limited Company Fees (NPR)

| S.N. | Authorized Capital (NPR) | Registration Fee (NPR) |

|---|---|---|

| 1 | Up to NPR 1,00,00,000 (one crore) | 15,000 |

| 2 | 1,00,00,001 – 10,00,00,000 (one crore one to ten crore) | 40,000 |

| 3 | 10,00,00,001 – 20,00,00,000 (ten crore one to twenty crore) | 70,000 |

| 4 | 20,00,00,001 – 30,00,00,000 (twenty crore one to thirty crore) | 1,00,000 |

| 5 | 30,00,00,001 – 40,00,00,000 (thirty crore one to forty crore) | 1,30,000 |

| 6 | NPR 40,00,00,001 – 50,00,00,000 (forty crore one to fifty crore) | 1,60,000 |

| 7 | Above 50,00,00,000 (above fifty crore) | 3,000 per one crore of authorized capital |

Step 5: OCR Review and Approval

OCR officers will:

- Review your application

- Verify documents

- Approve or request corrections

Timeline: 2–5 working days (longer if corrections needed)

Tip: Applications with professionally prepared documents get faster approvals.

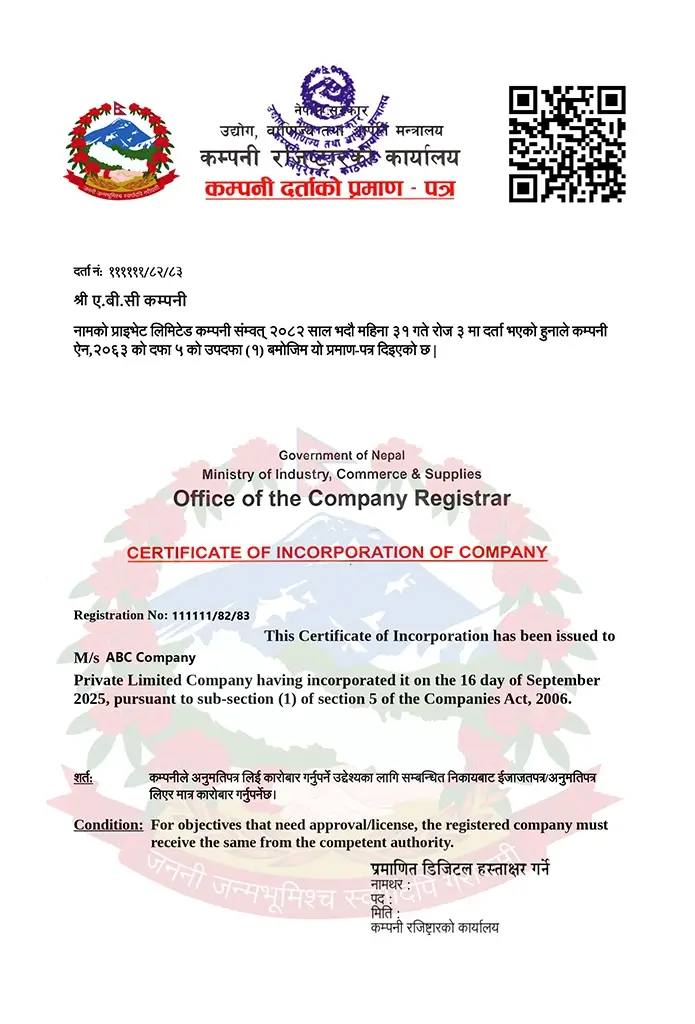

Step 6: Download Your Company Registration Certificate

Once approved, download your official Company Registration Certificate (PDF) directly from your OCR dashboard.

Post-Registration Compliance (What to Do After Company Registration)

Congratulations! Your company is now officially registered. To operate legally, complete these post-registration steps:

1. Register with the Local Ward Office

This is the first step after OCR registration. Every new company must register at the Ward Office where the business is located.

Process

- Visit the Ward Office of your company’s address.

- Submit the business registration application.

- Pay the local fee (usually NPR 500–5,000).

Required Documents

- Company Registration Certificate

- MOA & AOA

- Citizenship of directors/shareholders

- Rent agreement or property ownership paper

Timeline: 1–3 days

2. Apply for Business PAN & VAT at the IRD

Business PAN is needed for taxes, banking, and official work.

Process

- Visit the IRD website: https://www.ird.gov.np

- Go to Taxpayer Portal → Register for PAN/VAT.

- Fill out the online form.

- Submit and print the slip.

- Visit your tax office for verification.

- Receive your PAN certificate.

Required Documents

- Company Registration Certificate

- MOA & AOA

- Citizenship/Passport of authorized person

- Rent agreement / property papers

Timeline: 1–3 days

3. Create Company Stamp & Letterhead

- Make an official stamp with your company name, number, and address.

- Stamp size must follow OCR rules (max 38mm × 38mm).

- Make a letterhead with your name, number, address, PAN, and logo.

These are needed for banks, contracts, invoices, and official letters.

4. Open a Company Bank Account

A company bank account is required for business payments and to keep money separate from personal funds.

Process

- Visit a commercial bank with your documents.

- Complete KYC forms.

- Deposit the minimum amount (usually NPR 100,000 for Pvt. Ltd.).

Required Documents

- Company Registration Certificate

- PAN/VAT Certificate

- Board Resolution to open account

- Citizenship/Passport of directors

- MOA & AOA

Timeline: 2–7 days

5. Register for Social Security & Labor Compliance (If You Have Staff)

This is required under the Labour Act 2074.

Process

- Register at the Social Security Fund (ssf.gov.np).

- Enroll employees (mandatory for 10+ staff).

- Follow minimum wage rules (NPR 17,300 per month as of 2025).

Required Documents

- OCR and PAN certificates

- Employee citizenship and contracts

SSF Contribution

- 20% total (10% employer + 10% employee)

6. Internal Compliances

- Hold first board meeting within 1 month

- Issue share certificates within 2 months

- Appoint Auditor

- Maintain accounting records

7. Ongoing Annual Compliance

- AGM (Annual General Meeting) within 6 months

- File annual return with OCR

- Pay income tax by Ashwin end

Timeline for Company Registration in Nepal

| Process | Timeline |

|---|---|

| Name Reservation | 1–3 days |

| Document Preparation (MoA, AoA, IDs, etc.) | 2–5 days |

| Online Submission to OCR (CAMIS portal) | 1-2 days |

| Payment of Registration Fees | Same day |

| Issuance of Company Registration Certificate | 2–5 days |

| Ward Registration | 1–3 days |

| PAN / VAT Registration | 1–3 days |

| Company Bank Account Opening | 2–7 days |

Total Estimated Timeline:

- Local Businesses: 10-28 days.

- Foreign Investment: 3-4 weeks (FDI approval: 7-15 days extra).

Common Mistakes to Avoid

| Common Mistakes | Reason | Solution / How to Avoid |

|---|---|---|

| Name rejection | Similarity to existing company, wrong spelling, prohibited words | Check OCR online name search before applying |

| Wrong objectives in MoA/AoA | Too vague or unrelated objectives | Clearly define business activities |

| Incorrect Details | Delays approval | Double-check names, addresses, and capital |

| Incomplete documents | Missing citizenship, passport, or bank letters | Ensure all required documents are complete before submission |

Need Help? Get Expert Guidance

Avoid delays and rejections. Let Mr. Dipendra Shah (10+ years experience) guide you.

WhatsApp / Call: +977 9851 253 180

Frequently Asked Questions (FAQs)

Here are some common questions about the company registration in Nepal. We’ve kept the answers short and practical to make them easy to understand.

What documents are required for online registration?

Key documents include citizenship copies of promoters, Personal PAN, National ID, MOA & AOA,

Can I register a company by myself, or do I need an agent?

You can register yourself using the OCR online portal, but many entrepreneurs use company registration services like Company Sewa to save time and avoid errors.

How much does it cost to register a company in Nepal?

Costs depend on the authorized capital:

- Private Limited: NPR 1,000 – NPR 43,000+

- Public Limited: NPR 15,000 – NPR 3,00,000+

Refer to our registration fee tables for detailed amounts.

What should I do after registration?

After registration, apply for PAN/VAT, open a business bank account, create a company stamp, and register with the Social Security Fund if hiring employees.

Can I change my company name after registration?

Yes, you can apply for a name change via the OCR online portal, but it requires approval and may involve additional fees.

Is company registration mandatory in Nepal?

Yes, any business that intends to operate officially, open bank accounts, or enter contracts must be legally registered.

What types of companies can be registered online in Nepal?

Types include Private Limited Company, Public Limited Company, NGOs, and Foreign Branch Offices.

What are the ongoing compliance requirements for registered companies in Nepal?

Registered companies must:

- Hold an Annual General Meeting (AGM)

- Submit annual returns to the OCR

- Maintain proper financial records and audit reports

- File taxes with the Inland Revenue Department (IRD)

Can foreigners register a company in Nepal?

Yes. Foreigners can register a company in Nepal as a branch or subsidiary. They must comply with Nepal’s foreign investment laws and have a local representative. Registration is done through the OCR online portal.

References & Free Resources

Starting a company in Nepal requires not only following the registration process but also understanding the relevant laws, taxes, and compliance requirements. Here’s a curated list of official references, downloadable templates, and free resources to guide you:

Official Government Portals

- Office of the Company Registrar (OCR): https://ocr.gov.np – Company registration, name reservation, and official forms.

- Inland Revenue Department (IRD): https://www.ird.gov.np – PAN registration, VAT, income tax, digital service tax, and luxury tax information.

- Department of Industry: https://www.doind.gov.np – Industrial licenses and permits.

- Employees’ Provident Fund (EPF) Nepal: https://epf.org.np – Employer and employee contributions, registration, and compliance.

Relevant Laws & Acts

- Companies Act, 2063 (2006) – ⬇️ Download PDF | 🔗 Read Online

- Income Tax Act, 2002 (2058) – ⬇️ Download PDF | 🔗 Read Online

- The Foreign Investment and Technology Transfer Act, 2019 (2075) – ⬇️ Download PDF | 🔗 Read Online

- Employee Provident Fund Act – ⬇️ Download PDF | 🔗 Read Online

- The Labor Act, 2017 (2074) – ⬇️ Download PDF | 🔗 Read Online

- Digital Service Tax – 🔗 Read Online

- Luxury Tax, 2081 B.S (2024 A.D) – 🔗 Read Online

Free Tools & Templates

- Memorandum & Articles of Association Templates

- Memorandum of Association (MOA) – ⬇️ Download PDF | 🔗 Read Online

- Articles of Association (AOA) – ⬇️ Download PDF | 🔗 Read Online

- Business Plan Templates – ⬇️ Download PDF